wake county nc tax deed sales

To review the rules in North Carolina visit our state-by-state guide. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

Wake County Register Of Deeds Fully Reopens To The Public For In Person Service Wake County Government

Wake County collects on average 081 of a propertys assessed fair market value as property tax.

. The full Wake County real estate file is available in the following formats. Everyone is happy Wake County North Carolina recovers lost tax revenue the purchaser acquires title to the tax delinquent property free and clear of. Seizure and sale of personal property by the Sheriffs Office.

Wake County Real Estate Facts. Closed data is not available until the sale of the property is recorded in the MLS. The total sales tax rate in any given location can be broken down into state county city and special district rates.

A bill issued in July 2021 would cover the period of July 1 2021 through June 30 2022. Search real estate and property tax bills. According to state law the sale of North Carolina Tax Deeds are final and the winning.

This document serves as notice that effective April 1 2017 Wake County by resolution levies an additional 050 local sales and use tax. This can be enforced by individuals. Register for Instant Access to Our Database of Nationwide Foreclosure Listings.

The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300. To see a list of upcoming tax foreclosure sales please visit the websites of the law firms conducting the sales. Wake County has one of the highest median property taxes in the United States and is ranked.

Property Tax Collections Collections. The sale vests in the purchaser all right title and interest of Wake County in the property including all delinquent taxes which have become a lien since issuance of North Carolina tax deed. This rate includes any state county city and local sales taxes.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Wake County NC at tax lien auctions or online distressed asset sales. Prepared Food and Beverages This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that are subject to sales tax imposed by the State under GS. Search Any Address 2.

Home sale data is not an appraisal CMA competitive or comparative market analysis or home valuation of any property. The North Carolina state sales tax rate is currently. Pay tax bills online file business listings and gross receipts sales.

160A-3994 or designated as a historic landmark by a local ordinance adopted pursuant to GS. Wake County NC Sales Tax Rate. Wake County NC currently has 1209 tax liens available as of August 6.

The December 2020 total local sales tax rate was also 7250. Wake County NC currently has 22 tax liens available as of June 20. Yearly median tax in Wake County.

The relevant North Carolina statute is GS. 081 of home value. Ad Find Tax Foreclosures Under Market Value in North Carolina.

Or foreclosure of real estate. Ownership sale information and property detail for all Wake County real estate parcels is available for download. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina.

Attachment of bank accounts rental income or income tax refunds. Search For Deed Property Tax Pre-Foreclosure Info Today. Real property designated as a historic structure or site by a local ordinance adopted pursuant to GS.

North Carolina has a 475 statewide sales tax rate. Ad HUD Homes USA Can Help You Find the Right Home. Raleigh Homes for Sale 535666.

Annual tax bills are calculated for the fiscal taxing period of July 1 through June 30. The sale vests in the purchaser all right title and interest of Wake County in the property including all delinquent taxes which have become a lien since issuance of North Carolina tax deed. Learn about listing and appraisal methods appeals and tax relief.

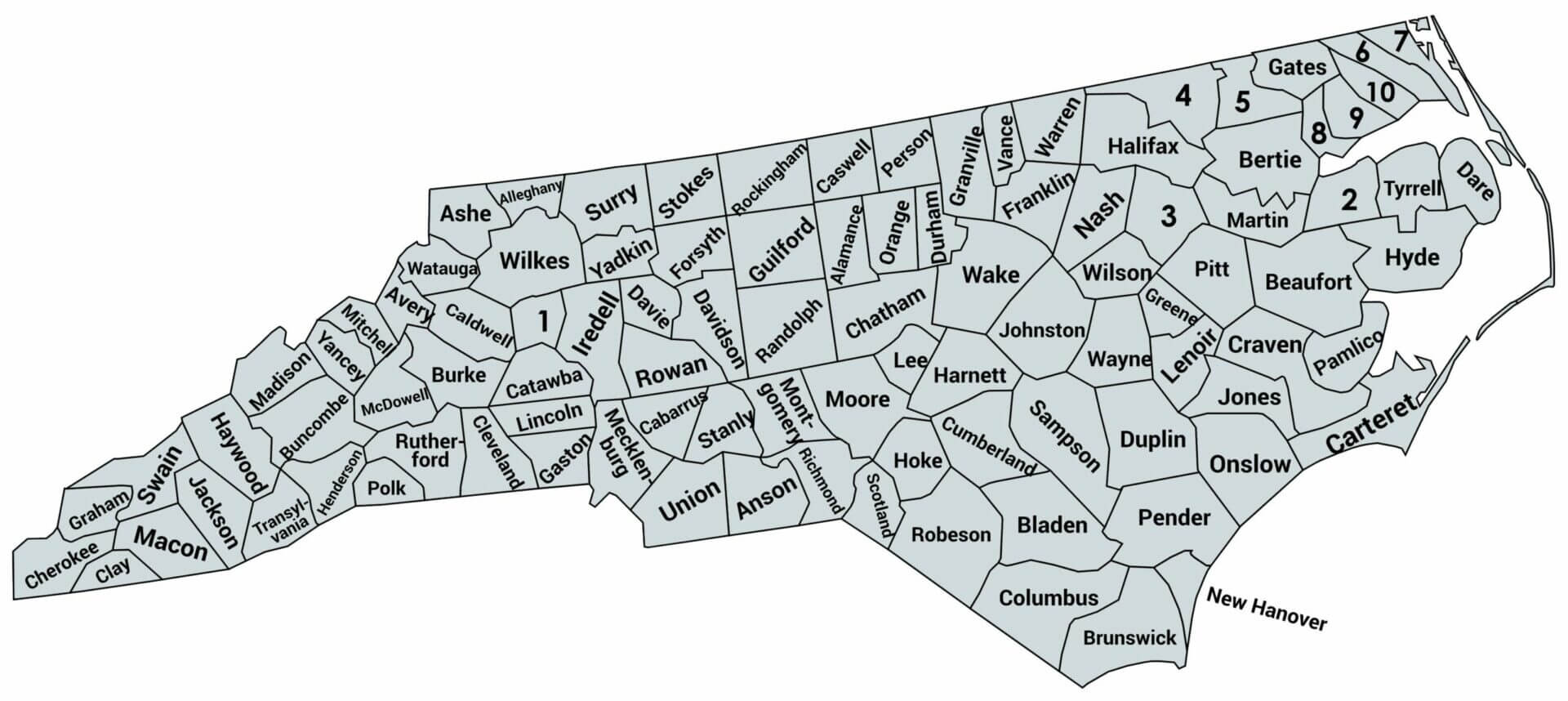

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. In North Carolina the County Tax Collector will sell Tax Deeds to winning bidders at the Wake County Tax Deeds sale. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes.

Action for collection may include garnishment of wages. Be Your Own Detective. Cary Homes for.

See Property Records Deeds Owner Info More. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from. The minimum combined 2022 sales tax rate for Wake County North Carolina is.

The additional 050 local sales and use tax is for the benefit and purpose of the Research Triangle Regional Public Transportation Authority dba GoTriangle and is to be. NC Sales Tax Rate. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Wake County NC at tax lien auctions or online distressed asset sales.

The current total local sales tax rate in Wake County NC is 7250. State Sales Tax and is remitted to the County on a monthly basis. 160A-4005 is designated a special class of property under authority of Article V Section 22 of the North Carolina Constitution.

North Carolina has a 475 sales tax and Wake County collects an. The median property tax. Has impacted many state nexus laws and sales tax collection requirements.

Wake County Transit Sales and Use Tax. The data files are refreshed daily and reflect property values as of the most recent countywide reappraisal. Find your North Carolina combined state and local tax rate.

View statistics parcel data and tax bill files. Enforced debt collection may begin immediately upon an account reaching delinquent status. They are not based on a calendar year.

75-1 the Unfair Trade Practice Act UTPA. Statements for real estate business and personal property may be printed using our Online Tax Bill Search. Everyone is happy Wake County North Carolina recovers lost tax revenue the purchaser acquires title to the tax delinquent property free and clear of all liens including mortgages created prior.

The 2018 United States Supreme Court decision in South Dakota v. The Wake County sales tax rate is. This is the total of state and county sales tax rates.

This table shows the total sales tax rates for all cities and towns in. This tax is collected by the merchant in addition to NC. Generally the minimum bid at an Wake County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

Imaps Information Wake County Government

March 2022 Carried Wake County Real Estate Median Price To Another Record High Of 430 000 Up 10k From February 2022 Wake County Government

Falls Community History Falls Baptist Church Wake Forest Nc

16 Simple Annual Report Template Free To Edit Download Print Cocodoc

Allen House Update The Old House Life

Imaps Information Wake County Government

Wake County Nc Foreclosures Foreclosed Homes For Sale 5 Homes Zillow

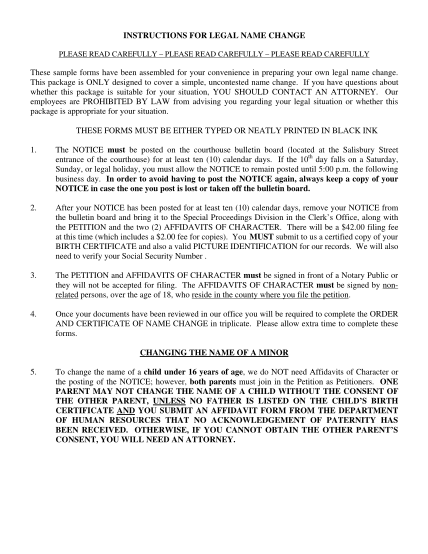

Free North Carolina Name Change Forms How To Change Your Name In Nc Pdf Eforms

Spring Has Sprung At The Allen House Volunteers Needed On Saturday The Old House Life

March 2022 Carried Wake County Real Estate Median Price To Another Record High Of 430 000 Up 10k From February 2022 Wake County Government

Complete List Of Tax Deed States

March 2022 Carried Wake County Real Estate Median Price To Another Record High Of 430 000 Up 10k From February 2022 Wake County Government

March 2022 Carried Wake County Real Estate Median Price To Another Record High Of 430 000 Up 10k From February 2022 Wake County Government

Imaps Information Wake County Government

Recently Sold Homes In Wake County Nc 85 030 Transactions Zillow